Question: How Long Will the Current Housing Shortage Last?

Answer: Years, and here is why…

If you are trying to buy a home in the current housing market, you no doubt already know that the inventory of homes for sale is at a historic low. These forces demand to exceed supply, causing multiple offers on the same home, increased purchase prices, and frustration for both buyers and their agents.

This situation all started over the last several years due to a reduction in the construction of homes and we are now paying the price for that. Typically, builders of new homes, with a little optimism and knowledge of US homebuilders and ingenuity, typically build an average of 2 million homes per year and achieve a supply-demand balance in around six years.

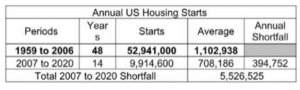

The US Census Bureau began collecting data in 1959. Between 1959 and 2006, builders built 52,941,000 houses, averaging 1,102,938 per year.

Builders started 9,914,600 homes or 708,186 homes per year between 2007 and 2020, which is 394,752 fewer starts per year than the historical average. During those years, the annual deficit totaled 5,526,525 homes. Builders began construction on 990,500 homes in 2020, which is still below the historical average of 1.1 million annual starts.

Housing starts were first reported by the US Census Bureau in 1959. Between 1959 and 2006, builders built 52,941,000 houses, averaging 1,102,938 per year.

What has caused the demand-supply imbalance?

Since 1959, market downturns have been exacerbated by changes in federal legislation or policies that influenced interest rates or tax policy, with the exception of the 1973 OPEC Oil Embargo. Although federal action is not currently driving the demand, its policies are causing builder production to suffer.

For those who don’t recall, the federal government required as many people as possible to buy a house in the early 2000s. To achieve this, lenders were encouraged (if not forced) to abandon traditional lending practices and make high-risk subprime loans.

Home loans were given out regardless of credit, jobs, or the amount of money put down. The unprecedented ease with which existing lending guidelines were circumvented was a major factor of the great recession.

Should you buy now or “wait it out”?

Homebuyers are now paying the price for the ongoing need for housing, which has been exacerbated by a slew of new projects that have pushed up housing demand.

The COVID-19 lockdowns, which required many people to work, teach and learn from home, resulted in a population that lived longer, preventing their homes from being recycled.

Millennials have now begun to enter the home-buying market. Institutional investors poured money into the market in droves. Restrictions and mandates at the local, state and federal levels increased, while interest rates fell to record lows, attracting more buyers. This has forced inventory to an even lower level.

The migration of people to Florida in record numbers has caused a substantially increased housing demand. The Greater Sarasota / Gulf Coast of Florida was one of the most moved to areas in the United States in 2020 and that trend is continuing. The disintermediation of labor and manufacturing, which started in 2006 and lasted until 2012, wreaked havoc on the homebuilding industry. After dipping as low as 430,600 housing starts in 2011, the production made a sluggish recovery. According to US Census data, that’s a 75 percent decrease, or 1,288,200 homes, from the 1,715,800 homes started in 2005.

“Are we in a bubble?” everybody wonders. The question on everyone’s mind, whatever we call it, is how long the shortage will last. According to the table above, America had a housing start deficit of 5,526,525 between 2007 and 2020.

Simple arithmetic can be used to address the question, “How long will the shortage last?” According to statistics, we are short 5,526,525 housing starts. Assuming that the current annual home starts of 1.1 million were sufficient — and that builders will build 1.5 million homes per year — the national home inventory would gain 400,000 starts each year to cover the shortfall.

Here’s how it works: When you divide 5,526,525 by 400,000, you get 13.8 years. That isn’t good news. It means the current housing situation is not going to improve for the foreseeable future, in fact, it could actually get worse.

Will the “bubble burst?” – we are not technically in a “bubble”, as explained above with the reasons for inventory levels being low for these reasons. Together with the fact that since the great recession, lending regulations are much stricter with better quality loans out there with way more people with equity in their homes, so even in the even of a cyclical economic slowdown, we should not see a “housing crash” as we saw back in 2007/2008.

In today’s market buyers have the benefit of record-low mortgage rates, which tend to offset the worry of the higher prices. Many buyers say they do not want to get into a “bidding war” or “we will wait and buy later once this craziness passes” – the staunch reality is that this situation is likely to continue for the next several years at least and mortgage rates are likely to rise – so buying now could actually be the best decision you can make and waiting could be something you regret when you find yourself paying more for your home and have a higher mortgage interest rate.

The bottom line: If you are seriously considering buying a home in Florida, “waiting it out” is not the solution for you and in fact, it could cost you more in the long run.

Expect to be in a multiple-offer situation for any home you wish to buy. Make sure you are working with a pro-active agent who knows your market, works as a full-time professional, has experience in writing contracts, making them more competitive, and understands the use of escalation clauses to help you win the home you wish.

Good luck with your home search!